Something unusual happened recently. BlackRock, the world’s largest asset manager, quietly updated a filing for its iShares Bitcoin Trust, known as IBIT. This wasn’t just a minor tweak. It was a direct warning about quantum computing and its potential to shake Bitcoin’s very foundations.

- BlackRock, managing trillions in assets, has warned about the potential threat of quantum computing to Bitcoin’s security.

- Quantum computers could potentially break the cryptographic systems that secure Bitcoin, making it vulnerable to attacks.

- The crypto community is already working on post-quantum cryptography to defend against this future threat, showing a proactive approach to long-term security.

Think about that for a moment. A financial giant, managing over $11.6 trillion in assets, is now openly discussing a futuristic threat to digital money. It’s not every day you see such a direct call-out in a formal disclosure. This move signals a serious shift in how big players view the long-term security of crypto.

Usually, these kinds of risk disclosures are exhaustive, covering everything from market volatility to regulatory shifts. But quantum computing making the cut alongside those common concerns? That tells us it’s no longer just a hypothetical issue for the big finance crowd. It’s a real, albeit distant, consideration.

For anyone holding Bitcoin, this means two things. First, Bitcoin isn’t immune to emerging tech threats. Second, institutions like BlackRock are actively weighing these risks as they build long-term strategies. The message is clear: preparing for a post-quantum world cannot wait.

The Giant’s Whisper: BlackRock and Bitcoin’s Quantum Question

BlackRock’s update to its iShares Bitcoin Trust (IBIT) filing came in early May 2025. It flagged quantum computing as a potential risk to Bitcoin’s long-term security. This was a rare move for them, and it certainly turned heads in the crypto world.

The filing specifically warned that if quantum technology advances far enough, it could break the cryptographic systems that secure Bitcoin. In their exact words, it could “undermine the viability” of the cryptographic algorithms. These algorithms are used not just in digital assets but across the global tech stack.

This marks the first time the world’s largest asset manager has directly called out this threat in a Bitcoin-related disclosure. It speaks volumes about how seriously institutional players are starting to take future-proofing crypto assets. It’s a sign that the conversation is moving from academic circles to mainstream financial strategy.

Why would a company of BlackRock’s stature bother with such a seemingly distant threat? Because they are building for the long haul. They understand that ignoring potential risks, even far-off ones, is a recipe for disaster. This isn’t just about Bitcoin; it’s about the entire digital economy’s future security.

The inclusion of quantum risk in an ETF filing, alongside more immediate concerns like market volatility and regulatory changes, suggests a new level of foresight. It shows that the biggest names in finance are not just reacting to current events. They are actively trying to anticipate the next big challenge. This proactive stance is something every investor should consider.

So, what exactly is this quantum tech that has BlackRock concerned? And how could it possibly affect something as robust as Bitcoin? It’s a question that deserves a closer look, especially for those who believe in the long-term promise of decentralized finance.

Understanding the Quantum Threat: Is Bitcoin’s Shield Strong Enough?

Quantum computers operate on principles vastly different from the traditional computers we use every day. Instead of processing information bit by bit, they can handle massive amounts of possibilities simultaneously. This makes them incredibly powerful, especially when it comes to cracking complex codes.

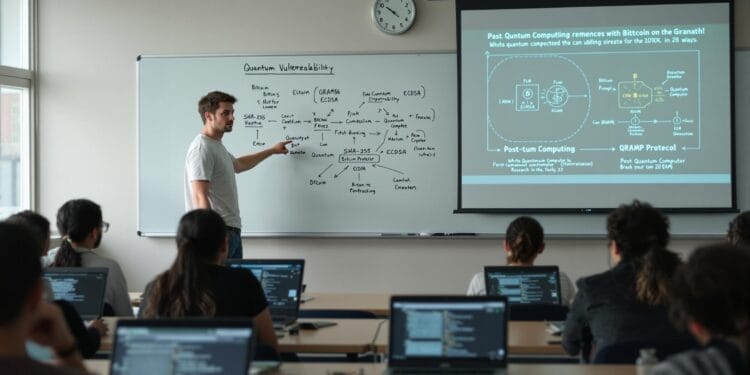

Bitcoin’s security relies on two main cryptographic systems: SHA-256 and ECDSA. These are the digital locks and keys that protect your Bitcoin address and ensure only you can authorize transactions. They have worked flawlessly for years, forming the backbone of Bitcoin’s trustless system. But quantum computers could change that equation.

Here’s the core worry: a powerful enough quantum computer might be able to reverse-engineer your private key from your public address. This is especially concerning during that short window after you’ve broadcast a transaction but before it’s fully confirmed on the blockchain. If that ever became possible, someone could hijack your transaction and steal your coins. It sounds like something out of a science fiction novel, doesn’t it?

However, it’s important to remember this isn’t an immediate threat. Most researchers agree that we are still at least 10 to 20 years away from quantum machines that could actually pull this off. The technology just isn’t there yet, not at the scale or stability needed to break Bitcoin’s current cryptography. So, there’s no need to panic and sell all your crypto tomorrow.

Still, the warning signs are flashing for a reason. Roughly a quarter of existing Bitcoin sits in older wallet formats. These could be more vulnerable if quantum leaps happen faster than expected. Even if the timeline is long, the crypto community knows it has to act early. Work is already underway on post-quantum cryptography, which is a security system designed to stand up to the next generation of computing power.

What is post-quantum cryptography, and why does Bitcoin need it? It’s a new field of study focused on creating cryptographic algorithms that are resistant to attacks from quantum computers. The idea is to build new, stronger digital locks before the quantum keys are invented. It’s a race against a future technological advancement, and the stakes are incredibly high.

Think of it like upgrading your home security system. You wouldn’t wait for burglars to develop new tools before you installed stronger locks, would you? The crypto world is taking a similar proactive approach. They are looking ahead, anticipating the threats, and working on solutions long before they become critical. This foresight is a testament to the community’s dedication to long-term security.

Building Tomorrow’s Defenses: How Crypto Prepares for a Quantum Future

While quantum computing still feels like a distant rumble, the crypto industry is already gearing up for it. The efforts underway are far more serious and coordinated than most people realize. This isn’t just a few developers tinkering in their garages; it’s a global push to secure the future of digital assets.

Changing the core protocol behind a blockchain like Bitcoin is never simple. It requires broad consensus from the community, careful testing, and a long lead time to implement. But that hasn’t stopped developers from floating some serious ideas regarding Bitcoin’s quantum resistance.

One of the most talked-about proposals is something called QRAMP, the Quantum-Resistant Address Migration Protocol. The idea behind QRAMP is to encourage users to move their coins from older, potentially vulnerable wallet formats into addresses protected by newer, quantum-safe algorithms. It would require a hard fork, which is no small lift, but it’s a serious plan to future-proof the network before a so-called “Q-Day” sneaks up on us.

Can Bitcoin, a network built on consensus, truly adapt to such a monumental shift? History shows that Bitcoin has adapted before, albeit slowly. The community’s decentralized nature makes rapid changes difficult, but also ensures that any major upgrade is thoroughly vetted. This slow, deliberate process is both a strength and a challenge when facing a future threat like quantum computing.

Some blockchains aren’t waiting around for Bitcoin to decide. Algorand, for example, has already integrated Falcon, a post-quantum digital signature algorithm. This algorithm has been officially vetted by the US National Institute of Standards and Technology (NIST). This means transactions on Algorand are already being backed by encryption that could hold up even if quantum machines go live tomorrow. They are truly ahead of the curve.

The Quantum Resistant Ledger (QRL) is another significant player in this space. It was built from day one with the quantum threat in mind. Instead of traditional cryptography, it uses XMSS, a hash-based signature scheme. While it’s not a major player in market cap terms, QRL is one of the most advanced projects in terms of pure security design. It’s a testament to forward-thinking development.

Of course, none of this is simple to implement. Quantum-safe cryptography often comes with trade-offs. Algorithms like Falcon are compact and efficient, but they still require more computing resources than traditional ones. This means potentially slower transaction times or higher fees, which are considerations for any blockchain network.

Moreover, switching everyone—miners, exchanges, wallet apps, and individual users—to a new cryptographic standard could be a logistical nightmare. Imagine trying to coordinate a global upgrade for billions of users. It would need to be planned years in advance, with clear instructions and incentives, to avoid chaos and widespread errors.

Plus, there’s a delicate balance to strike. Move too soon, and you risk breaking things or relying on technology that isn’t battle-tested. Wait too long, and you’re exposed to a potentially catastrophic threat. It’s like trying to predict the exact moment a storm will hit while also building a new, stronger roof.

That’s why many in the space are eyeing a 10-to-20-year window as a rough estimate for when quantum computing becomes a real threat. But even with that generous timeline, nobody wants to be the last to prepare. The crypto community understands that proactive measures are the best defense against future uncertainties. What are the challenges in making Bitcoin quantum-resistant?

The Road Ahead: Securing Bitcoin in a Post-Quantum World

If there’s one lesson from the quantum conversation so far, it’s this: being early matters. When it comes to technology that could one day rewrite the rules of digital security, waiting around just isn’t an option. The stakes are too high, and the potential consequences too severe, to adopt a wait-and-see approach.

So, what does preparation look like for the crypto ecosystem? For developers, it starts with testing and integrating quantum-resistant algorithms into existing systems. Some are already experimenting with “hybrid” approaches, using both traditional and post-quantum cryptography side by side. This way, networks aren’t caught off guard if, or when, Q-Day arrives. It’s a smart way to hedge against future risks.

For crypto businesses—exchanges, custodians, and wallet providers—the job is twofold. First, they must ensure their own infrastructure is future-proof. Second, they need to make sure their users know what’s coming and how to prepare. Education and user experience will play a huge role here. Migrating keys and updating protocols isn’t something the average holder can or should do alone. How can exchanges and wallet providers guide users through this complex upgrade?

And then there’s the regulatory side—maybe not the most exciting part of crypto, but an absolutely critical one in this context. You are already seeing movement: the NIST finalized several post-quantum cryptographic standards in 2024. That gives the industry a starting point, a common language to build around. It provides a baseline for what “quantum-safe” actually means.

But what’s still missing is a clear regulatory push that says, “Here’s how and when this should happen.” Good policy here wouldn’t mean clamping down on innovation. It would mean supporting it. Think: funding open-source research, incentivizing post-quantum upgrades, and creating frameworks that help institutions adopt secure standards without killing momentum. It’s about smart, supportive guidance.

The US government began preparing for the quantum threat as far back as 2016. In 2024, the NIST’s move was sparked by growing fears that quantum computers could one day break the encryption protecting everything from Bitcoin to national security infrastructure. This isn’t just a crypto problem; it’s a global security concern.

BlackRock didn’t need to bring up quantum risk in its ETF filing. But it did. And when a company of that size puts it in writing, it turns vague rumors into something much more real. It legitimizes the concern and forces the industry to pay attention. This is a slow burn, not a sudden explosion.

The transition to a quantum-resistant crypto world isn’t going to happen overnight. It’ll be messy, slow, and full of tough technical choices. But it has to happen. The alternative is far worse. When will quantum computers pose a real threat to Bitcoin?

Finally, waiting until quantum computers are actively breaking SHA-256 in the wild would already be too late. The time to prepare is now, while the threat is still on the horizon. The crypto community has a history of innovation and resilience. This challenge is just another chapter in that ongoing story.