The world of memecoins often feels like a wild carnival. One minute, everyone is cheering for the new star attraction, a token with a catchy name or a famous face attached. The next, the ride grinds to a halt, leaving investors with little more than a dizzying memory and an empty wallet. This familiar pattern now sits at the heart of a new legal challenge.

- A class action lawsuit alleges that Meteora and its co-founder, Ben Chow, orchestrated a fraud involving the memecoins LIBRA and MELANIA. The plaintiffs claim these tokens used famous connections as a facade for a liquidity trap.

- The lawsuit clarifies that public figures like Melania Trump and Argentine President Javier Milei were “merely the window dressing” and not to blame for the alleged scheme. The focus remains on Meteora and Kelsier Ventures for marketing and execution.

- Ben Chow has denied direct involvement and resigned from Meteora amid the growing scandal, while the legal process aims to uncover the truth behind these speculative crypto ventures.

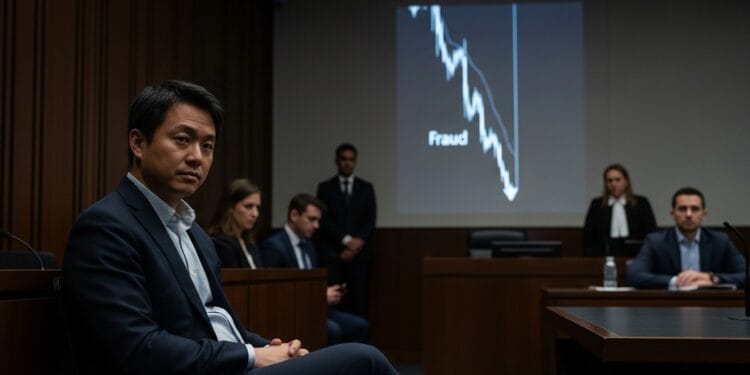

A class action lawsuit has recently sharpened its focus, pointing fingers at Meteora and its co-founder, Ben Chow. The claim? That these parties orchestrated a fraud involving two particularly high-profile memecoins: LIBRA and MELANIA. The plaintiffs say these tokens were not what they seemed, despite their famous connections.

The amended complaint, filed just recently, paints a picture of a calculated scheme. It suggests the defendants “borrowed credibility” from real-world figures and themes. Think of the official Melania Trump coin, MELANIA, or the Argentine revival coin, LIBRA. These names, the complaint argues, were just window dressing.

They were “props to legitimize what was actually a coordinated liquidity trap,” the lawsuit states. A liquidity trap, in simple terms, is a setup where early investors or developers sell off their tokens after a price surge, leaving later buyers with tokens that quickly lose most of their value. It is a classic pump-and-dump maneuver, but with a modern, crypto twist.

The complaint makes a point to clear the public figures themselves. Melania Trump and Argentine President Javier Milei were “merely the window dressing,” it says. They are not to blame for the alleged scheme. The focus remains squarely on Meteora and Kelsier Ventures, a firm led by Hayden Davis, which reportedly ran marketing for these token launches.

Consider the MELANIA memecoin. It was promoted as the official cryptocurrency of the U.S. first lady. It saw a rapid surge in price, then crashed just as quickly after its launch. Developers faced accusations of dumping their holdings, leaving others in the lurch. It was a swift, brutal fall for many who bought in.

A similar story unfolded with LIBRA. This token was marketed as a way to fund small businesses in Argentina. It soared in value within hours of its debut. Then, just as fast, it plummeted. The sudden drop caught many off guard, illustrating the volatile nature of these speculative assets.

President Milei himself initially promoted LIBRA on his personal X account. He later deleted the post after the token’s collapse. This involvement led to fraud charges against him related to the LIBRA promotion. However, a separate investigation by Argentina’s anti-corruption office found he did not violate public ethics laws. This split decision highlights the murky waters surrounding celebrity endorsements in the crypto space.

The Allegations Against Chow

The class action complaint places Ben Chow squarely at the center of this alleged enterprise. It claims he was “at the center of the enterprise.” He reportedly assembled a team to carry out the scheme. This team included Ng Ming Yeow, a co-founder of both Meteora and Jupiter, along with the Davis family from Kelsier Ventures.

The list of defendants in the class action lawsuit is extensive. It names Benjamin Chow, Meteora, Kelsier Ventures, Hayden Davis, Gideon Davis, and Charles Davis. This shows the breadth of the alleged operation and the number of parties involved in its execution.

The lawsuit alleges that this team launched and marketed at least 15 tokens. They supposedly followed a similar pattern for each. The current lawsuit, however, focuses on five specific tokens. These are LIBRA, MELANIA, ENRON, TRUST, and M3M3. Each name carries its own weight, some perhaps chosen for their ironic or attention-grabbing qualities.

Chow, for his part, has denied direct involvement. He stated on X in February that neither he nor Meteora received any tokens or possessed insider information related to the Libra project. This public statement aimed to distance himself from the controversy as it began to bubble up.

Soon after, in the same month, Chow resigned from Meteora. This move came amid the growing scandal surrounding the Libra token. It was a swift exit, following the public outcry and the legal challenges that started to take shape. The Block, a news outlet, has reached out to Chow and Meteora for their comments on these recent developments.

This situation reminds us that the shiny veneer of a new token, especially one linked to a public figure, can sometimes hide a less appealing reality. It is a stark reminder to look beyond the hype. Always consider the underlying mechanics and the people behind the project. The legal process will now work to peel back those layers, seeking clarity in a space that often thrives on speed and speculation.