Bitcoin, that digital bellwether, has found a comfortable perch above $105,000 this week. It feels a bit like the market took a deep breath, settling down after a period of holding its own. We’re seeing a calmer macro backdrop, a welcome boost in liquidity, and even a quiet return of institutional money. It’s not a party yet, but the tension has certainly eased.

- Bitcoin has stabilized above $105,000, indicating a calmer market with increased liquidity and institutional interest. This follows a period of deleveraging and a shift from fear to caution.

- Institutional investors are quietly accumulating crypto, with significant additions to Bitcoin and Ethereum holdings, suggesting long-term conviction over speculative trading.

- Policy clarity, particularly from the U.S. Treasury and IRS regarding crypto ETPs, is boosting market confidence and legitimizing staking, paving the way for further institutional adoption.

The largest cryptocurrency traded near $105,200 on Tuesday morning. This follows a steady rebound from the $100,000 mark, a level many analysts now see as a solid foundation after some recent dips. Ethereum, its close companion, hovered around $3,550. Meanwhile, Solana and BNB saw modest declines, according to the latest figures.

The total crypto market capitalization now sits around $3.6 trillion. This renewed appetite for risk comes as the U.S. government looks set to reopen, a welcome sigh of relief after nearly seven weeks of shutdown. Positive regulatory signals for the industry are also playing their part, like a gentle tailwind.

Timothy Misir, Head of Research at BRN, suggests this week’s price action might be the first true consolidation since the deleveraging wave we saw in October and early November. Think of deleveraging as the market shaking out its riskiest bets, forcing traders to close positions and clean up their books.

“The market’s tone has shifted from fear to caution, and that often precedes resilience,” Misir told us. He noted that spot volumes (actual buying and selling of crypto, not derivatives) are rising. Leverage (trading with borrowed money) is being flushed out. The overall structure looks healthier. “We’re seeing quiet rebuilding beneath the surface,” he added, a phrase that always makes me lean in a little closer.

Institutional Flows Signal Quiet Accumulation

While the demand for crypto exchange-traded funds (ETFs) remains a bit uneven, the underlying institutional accumulation of crypto has definitely picked up. It’s like the big players are quietly filling their baskets, away from the daily headlines.

BRN’s analysts pointed out some interesting moves. Strive, for instance, added a hefty $162 million in Bitcoin. Strategy, another significant player, acquired an additional $50 million. Bitmine increased its Ethereum holdings by a substantial 34%, pushing its total ETH past 3.5 million, representing 2.9% of the entire Ethereum supply.

These additions, combined with a dip in open interest (the total number of outstanding derivative contracts), suggest a rotation. Money is moving away from speculative, leveraged bets and into direct spot accumulation. It’s a classic sign of long-term conviction, rather than short-term gambling.

This kind of positioning often sets the stage for sustained recoveries. Misir believes the $100,000 to $108,000 zone is now likely emerging as a mid-term base for Bitcoin. “Momentum is building,” he observed, “but upside remains capped near $108,500 to $111,000 unless inflows accelerate.” It’s a patient game, not a sprint.

Options data, which gives us a peek into where traders expect prices to go, supports this idea of patient accumulation over outright euphoria. QCP Capital noted that traders are split on Bitcoin’s ability to retest its all-time highs this year. Some call buyers are positioned near $120,000 to $150,000, betting on a rise. Others are selling upside spreads around $135,000 to $140,000, suggesting they don’t expect prices to climb much higher than that.

In a recent note, QCP Capital explained that Bitcoin markets continue to absorb legacy supply shocks. These come from older wallets, which occasionally move large amounts of Bitcoin, creating selling pressure. The market remains structurally range-bound, they said, unless fresh inflows resume. It’s a tug-of-war, with no clear winner just yet.

Policy Clarity Fuels Market Confidence

Crypto’s recent stabilization also lines up with a broader shift in global sentiment. The U.S. Senate’s bill to reopen the government is a big deal. It could soon restore fiscal operations after that lengthy shutdown. Progress on new trade frameworks with India and China has also helped cushion overall risk appetite.

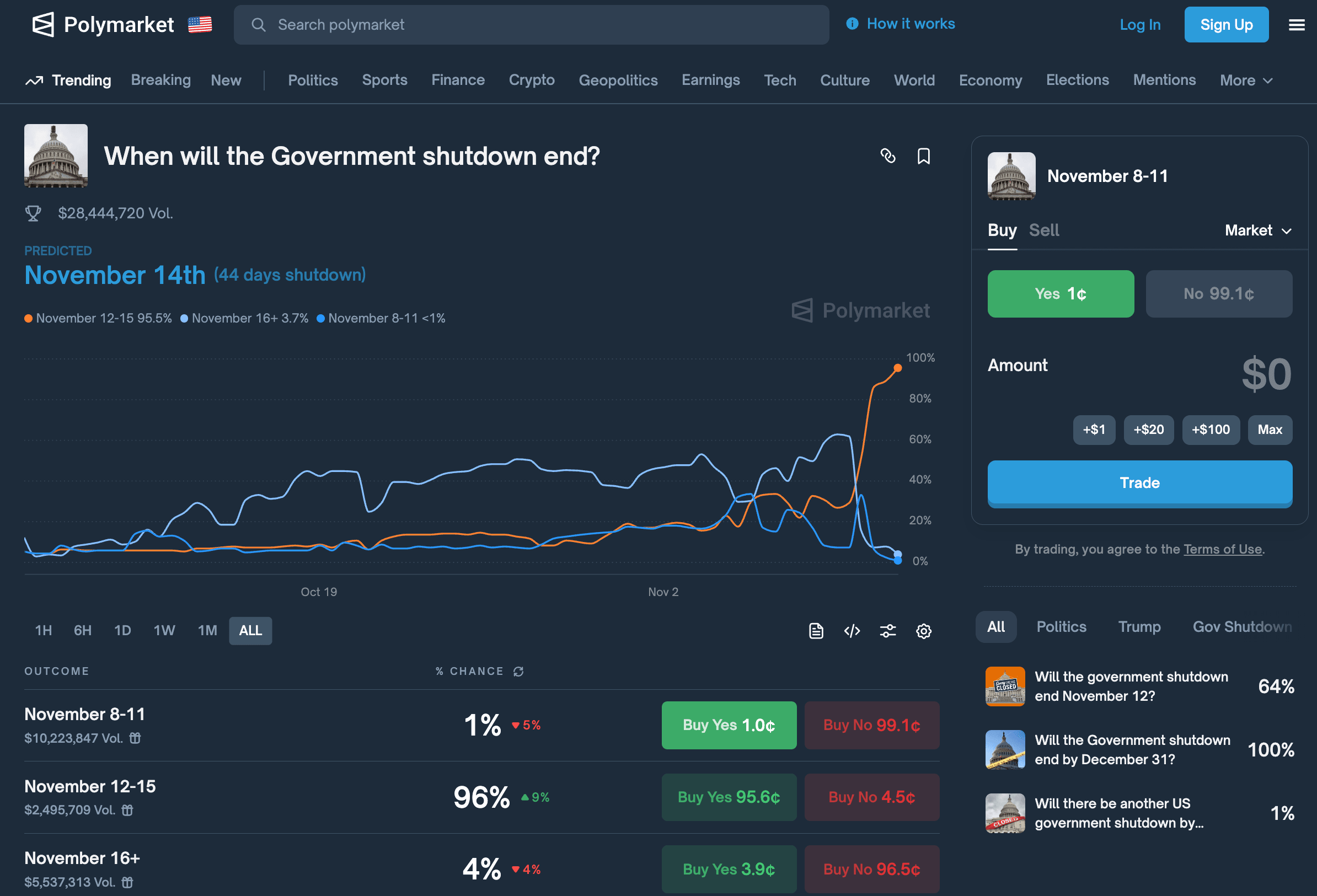

On decentralized prediction platforms like Polymarket, the odds were heavily in favor of the U.S. government shutdown ending this week. A 96% chance, in fact. Policymakers reached a tentative deal, which now heads to the House. It seems even the most cynical among us are betting on a return to normalcy.

Polymarket users bet on U.S. government reopening this week. Image: Polymarket.

In a parallel boost to market confidence, the U.S. Treasury and IRS issued long-awaited guidance. This guidance permits crypto exchange-traded products (ETPs) to stake digital assets and distribute rewards. An ETP is a type of security that tracks an underlying asset, like an ETF, but can also include other structures.

Experts believe this move could accelerate institutional adoption across proof-of-stake networks. Think Ethereum and Solana, for example. Proof-of-stake is a method where users can “stake” their crypto to help secure the network and earn rewards, rather than using energy-intensive mining.

“This policy clarity helps legitimize staking within regulated vehicles,” Misir added. He sees it as a structural milestone for the next wave of ETF products. “ETF flows, policy support, and cleaner positioning all point to stabilization, but not breakout conditions yet.” It’s a careful dance, but the steps are becoming clearer.

So, while the market isn’t exactly roaring, it’s certainly finding its footing. The quiet accumulation by institutions, coupled with a more predictable policy environment, paints a picture of a market maturing. It’s less about wild swings and more about building a solid foundation. The question now is, how long will this patient rebuilding phase last before the next big move?