There are polite ways to end a relationship. Then there is the way JPMorgan Chase does it. Last month, the banking giant showed Jack Mallers the door. Mallers is the CEO of Strike, a company built on making Bitcoin useful for everyday payments. You would think his bank would have a clear reason for closing his accounts.

- JPMorgan Chase abruptly closed the accounts of Strike CEO Jack Mallers, offering only the cryptic explanation, “We aren’t allowed to tell you.” This action occurred despite Mallers’ father being a long-time private client of the bank.

- The incident has fueled speculation within the crypto industry regarding an unofficial “Operation Chokepoint 2.0,” an alleged campaign by regulators to systematically cut the crypto industry off from traditional banking services.

- Conversely, some crypto proponents view these banking restrictions as validation for Bitcoin’s existence, arguing that the permissioned nature of traditional finance necessitates a permissionless alternative.

You would be wrong.

According to Mallers, the bank’s only explanation was a cryptic line. “We aren’t allowed to tell you.” It’s a response that clarifies absolutely nothing, which is a special kind of corporate art form. The move was especially odd given his family’s history with the bank. “My dad has been a private client there for 30+ years,” Mallers wrote on the social media platform X.

This wasn’t just a quiet digital severance. A formal letter arrived. It spoke of “concerning activity” on his account and the bank’s deep “commitment to regulatory compliance.” It also gently informed him that he probably shouldn’t bother trying to open new accounts with them in the future. It was the financial equivalent of “it’s not you, it’s me,” if “me” was a multi-trillion dollar institution with a team of lawyers.

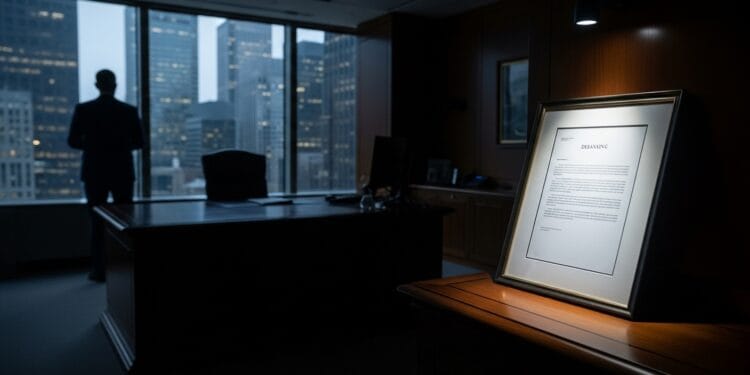

What does a Bitcoin CEO do when he gets a letter like this? He doesn’t just file it away. He gets it framed. Mallers shared a picture of the framed letter, a piece of defiant office decor. A trophy from a quiet war most people don’t even know is happening.

So proud I got it framed 🙏 pic.twitter.com/g3a2f2zrtZ

— Jack Mallers (@jackmallers) May 26, 2024

To an outsider, this might look like a simple, if strange, banking dispute. A private company exercising its right to refuse service. But in the crypto industry, an event like this lands differently. It lands like a warning shot.

The Ghost of Chokepoint

Almost immediately, comments on social media turned to a single theory. Operation Chokepoint 2.0. It sounds like the title of a spy thriller, but it refers to a very real fear in the digital asset space. The original Operation Chokepoint was a government initiative from the last decade that pressured banks to cut ties with businesses deemed “high-risk,” like payday lenders and firearms dealers.

The “2.0” version is what many in crypto believe is happening now, under the current administration. It’s an alleged, unspoken campaign by federal regulators to systematically cut the crypto industry off from the traditional banking system. Think of it as turning off the water and power to a part of the economy the government finds distasteful. There’s no law passed, no public declaration. Just a series of quiet, unexplained account closures that make it nearly impossible for crypto companies and their executives to operate.

Is that what happened to Jack Mallers? JPMorgan Chase isn’t saying. That’s the point. The ambiguity is the weapon. By citing vague “regulatory compliance” issues, a bank can sever ties without needing to provide concrete evidence of wrongdoing. It creates a chilling effect. Other banks see this and wonder if their crypto clients are worth the headache from regulators.

This isn’t a new problem. For years, crypto startups have struggled to find and keep stable banking partners. Payroll, vendor payments, rent. All of it runs on the old financial rails. When access to those rails is threatened, a company’s survival is on the line. Mallers’ case is notable because of his high profile. If the CEO of a major Bitcoin company can be “debanked,” who is safe?

Last month, J.P. Morgan Chase threw me out of the bank.

It was bizarre. My dad has been a private client there for 30+ years.

When I asked why, their only response was: "We aren’t allowed to tell you."

Operation Choke Point 2.0 is alive and well, folks.

— Jack Mallers (@jackmallers) May 26, 2024

The issue has become so pronounced that it has drawn political attention. In August, President Trump signed an executive order aimed at penalizing financial firms that cut off services to crypto-related businesses without a clear, legal reason. His administration had previously stated it was working to end any regulatory actions that unfairly targeted the industry.

Yet, here we are. The incident with Mallers suggests that whatever policies were put in place, the pressure on banks remains. Or perhaps the banks themselves have decided the risk is too great, regardless of official policy.

A System Working as Intended

Not everyone sees this as a tragedy. For some of crypto’s most ardent believers, events like this are not a bug. They are a feature. They are the entire reason Bitcoin was created in the first place.

Paolo Ardoino, the CEO of Tether, replied to Mallers’ post suggesting what happened is “for the best.” In a separate post, he was more direct. “Bitcoin will resist to the test of time,” Ardoino wrote. “Those organizations that try to undermine it, will fail and become dust. Simply because they can’t stop people choice to be free.”

This is the core argument of the crypto movement. The existing financial system is permissioned. A handful of powerful institutions get to decide who can and cannot participate. They can freeze your funds, close your accounts, and cut you off from the global economy with a few keystrokes. And they don’t even have to tell you why.

Bitcoin, in this view, is the alternative. It is a permissionless system. No one can stop you from opening a wallet. No one can prevent you from receiving a transaction. No one can seize your assets without your private keys. For Ardoino and others, every time a bank debanks a crypto user, it only serves as a powerful advertisement for a parallel financial system.

It proves the point. It validates the mission. It pushes more people to consider an alternative where the rules are written in code, not in the backrooms of a corporate compliance department.

So, Jack Mallers has one less bank account. But he also has a new piece of art for his wall. A framed reminder of the conflict between the old world of finance and the new one he is trying to build. A conflict that is far from over.