A familiar energy often signals Strategy, the Nasdaq-listed firm, is making moves in the crypto markets. This time, it’s a fresh funding round, one that pulled in far more cash than first planned. The company just priced its new 10% Series A Perpetual Stream Preferred Stock, known by its ticker STRE, at €80 per share.

- Strategy has successfully raised €620 million (approximately $715 million) through its new Series A Perpetual Stream Preferred Stock (STRE), exceeding initial fundraising expectations. This capital is designated for general corporate purposes, including bitcoin acquisition and working capital.

- The STRE offering features a 10% annual dividend rate, potentially increasing to 18% if dividends are deferred, making it a high-yield instrument designed to reward investor risk and provide Strategy with financial flexibility.

- This offering is part of Strategy’s ongoing “layered capital framework” of perpetual preferred-stock issuances, aimed at financing continuous bitcoin accumulation without diluting common shareholders, following previous successful offerings like STRC, STRF, STRK, and STRD.

This offering wasn’t small. It generated gross proceeds of €620 million, which translates to about $715 million. That’s a hefty sum, especially when you consider where that money is headed: “general corporate purposes, including the acquisition of bitcoin and working capital.”

A New Layer in the Bitcoin Stack

Each STRE share comes with a €100 stated value. It promises quarterly cash dividends, starting December 31, 2025, at a 10% annual rate. But here’s where it gets interesting: that rate can climb to 18% if dividends are deferred. It’s a high-yield instrument, ranking among the more generous offerings in Strategy’s preferred stock lineup.

This structure isn’t just about big payouts. It’s a clever design. It aims to reward investors who are willing to accept the risk of deferred payments. For Strategy, it offers a valuable bit of flexibility, especially during those times when funding might get a little tight.

The initial plan was for a smaller raise. Strategy filed on November 3 for about 3.5 million shares. But the market spoke loudly. The final issuance more than doubled, landing at 7.75 million shares. This indicates there’s still a strong appetite out there for high-yield investments tied to Strategy’s unique, bitcoin-focused capital structure.

This STRE offering isn’t a one-off event. It’s the latest in a series of perpetual preferred-stock offerings Strategy has rolled out this year. You might recall STRC? That was the first “Treasury Preferred” series, introduced back in July. It raised a substantial $4.2 billion, all earmarked for bitcoin purchases.

And before STRE even hit the public market, other fixed-yield issues like STRF, STRK, and STRD were already at work. These pieces all fit together, building what Strategy calls a “layered capital framework.” The goal is straightforward: keep financing ongoing bitcoin accumulation without directly diluting the common shareholders. It’s a bit like adding new floors to a building without touching the ground floor tenants.

The Bitcoin Accumulation Pace

While Strategy has been busy raising capital, its pace of bitcoin accumulation has seen a notable shift. The company’s third-quarter results showed a marked slowdown. They added just 1,417 BTC during that quarter. Compare that to the second quarter, when they picked up more than 9,000 BTC, or the first quarter, which saw roughly 12,000 BTC added to their stash.

Despite the slower pace, Strategy’s total holdings continue to grow. The firm now holds 640,808 BTC. To put that in perspective, that’s about 3.1% of the total bitcoin supply. It’s a significant chunk, no doubt.

Another metric worth watching is the firm’s mNAV multiple. This is a key gauge of its market premium. It narrowed to roughly 1.2 times, reaching its lowest point since early 2023. Think of mNAV as how much extra value the market places on Strategy’s bitcoin holdings beyond their direct market price. A lower multiple suggests less enthusiasm, at least for now.

Analysts, however, don’t seem overly concerned by this slowdown. They suggest the pullback looks more cyclical than structural. In other words, it’s a temporary dip, not a fundamental flaw in the strategy. They point out that Strategy remains on track to hit its 30% bitcoin-yield target for 2025.

The expectation is that the company could re-accelerate its accumulation efforts. This would likely happen once market premiums and funding conditions improve, perhaps sometime next year. It’s a waiting game, it seems, for the right moment to step back on the gas.

The broader bitcoin market has been a bit of a rollercoaster lately. Bitcoin itself is hovering above $100,000. This comes after a volatile week, with continuing macroeconomic pressures adding to the uncertainty. It’s a reminder that even the biggest players operate within a larger, sometimes unpredictable, financial landscape.

Strategy’s Stock Performance

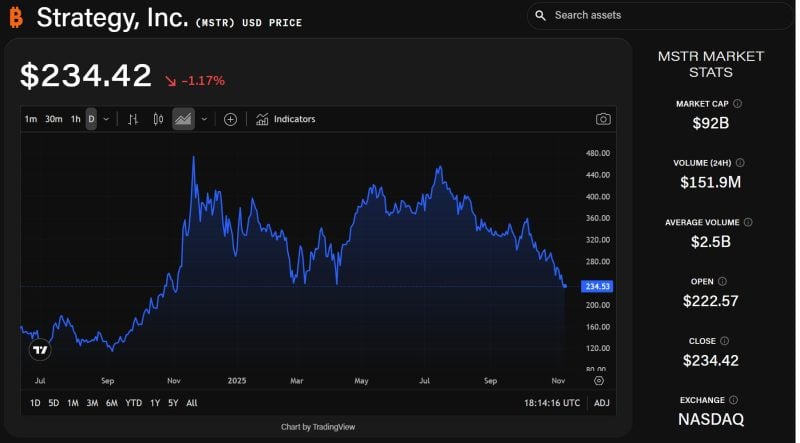

Against this backdrop of successful fundraising and a measured bitcoin accumulation, how has Strategy’s primary MSTR stock performed? On Friday, shares were trading just under $235. This price puts them teetering on new year-to-date lows.

It’s a curious contrast, isn’t it? The company secures a substantial new funding pipeline for bitcoin, yet its stock price reflects a different sentiment. It shows how various market forces, beyond just bitcoin accumulation, play a role in investor perception.

The market often has its own rhythm, distinct from a company’s operational successes. Investors weigh many factors: broader economic trends, interest rate expectations, and the general mood around growth stocks. Strategy’s journey continues to offer a fascinating study in how traditional finance and the digital asset world intersect.

Will the new STRE capital, combined with improving market conditions, provide the lift MSTR shares need? Or will the market continue to price in the recent slowdown in bitcoin purchases? We’ll be watching to see how this layered strategy plays out in the coming quarters.