The narrative around Galxe has fundamentally shifted. For years, the platform was dismissed by sophisticated investors as merely a “quest frontend”—a necessary but low-margin tool for driving social media activity. The 2025 data, however, confirms that Galxe has executed a critical transformation, positioning itself not as a marketing tool, but as a full-stack infrastructure layer for Web3 growth and distribution. The conclusion is clear: Galxe is now attempting to capture the entire lifecycle of a protocol, from early awareness to the high-stakes moment of the Token Generation Event (TGE), by unifying identity, intelligence, and execution on its dedicated chain, Gravity. The alpha here is determining if the market will price this unified growth infrastructure like a high-margin SaaS business, which is exactly what the new Galxe Business+ model demands.

- [Insight 1: The Core Thesis] Galxe is pivoting from a marketing tool to a full-stack infrastructure layer capturing the entire protocol lifecycle via its dedicated chain, Gravity.

- [Insight 2: The Key Data Point] Gravity achieves 4,500 TPS and 1.1-second blocks, engineered specifically to handle peak TGE distribution load via Earndrop-as-a-Service.

- [Insight 3: The Market Implication] Monetization shifts to a recurring SaaS model (Business+), demanding the market price Galxe as high-margin infrastructure, not a low-margin frontend.

The Scale and the Sybil Defense Layer

The raw numbers confirm Galxe’s dominance in user acquisition. The platform boasts over 36 million total users and reports a daily active user count of 1 million, partnering with more than 7,770 projects across multiple chains. In 2025 alone, users logged approximately 184 million quest participations. For any protocol launching today, this is the necessary distribution channel. But sheer volume is meaningless if the users are bots. This is the central problem Galxe had to solve, and the answer lies in its identity stack: Passport and Score.

Passport and Score are the core Sybil resistance mechanisms, filtering eligibility across all products. This is not just a feature; it is the foundation of the monetization strategy. When Arbitrum ran its Odyssey campaign, it engaged over 623,000 unique users, resulting in 1.7 million NFTs minted. When Linea ran its Voyage, it attracted 5.6 million wallets and generated 50 million testnet transactions. These programs cannot run successfully without a high degree of confidence that the participants are high-intent users, not farm accounts. Galxe is selling verifiable, high-signal contribution data, moving the conversation away from vanity metrics toward genuine onchain outcomes.

The Infrastructure Pivot: Gravity and Earndrop

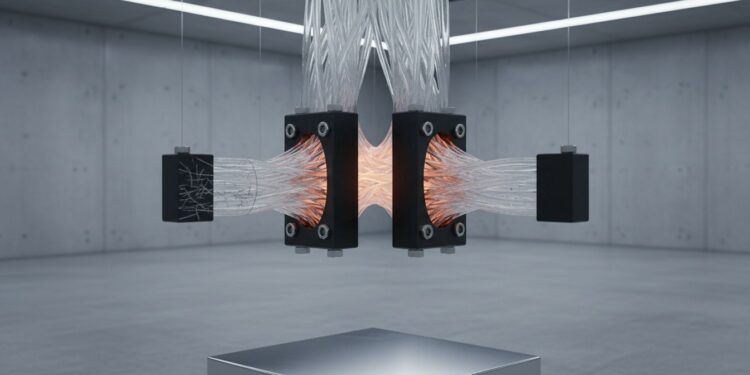

The most significant technical development is the launch and hardening of Gravity, Galxe’s dedicated EVM-compatible execution layer. Why build a chain just for growth programs? Because the operational demands of a TGE or a massive token distribution are too high to rely on generalized L2s or congested mainnets. Gravity, currently operating as an Arbitrum Nitro-based rollup, is engineered for performance.

The data on Gravity’s Alpha Mainnet is compelling: it ranks in the top 10 amongst all blockchains on Chainspect, delivering roughly 1.1-second blocks and 4,500 transactions per second (TPS). Furthermore, the engineering team focused on optimizing the core execution client, maintaining a performance-focused fork of Paradigm’s Reth client, dubbed Gravity Reth. Benchmarks show Gravity Reth achieving 1.5 to 1.9 gigagas per second in ERC-20 workload processing. This is infrastructure built to handle peak load.

This performance is critical because it directly supports the new flagship product: Earndrop, or Airdrop-as-a-Service. Launched in early 2025, Earndrop standardizes the chaotic process of large-scale token distribution. It handles everything from automated vesting schedules (linear/cliff) and multichain logistics (supporting Ethereum, Solana, Base, etc.) to crucial operational risk mitigation like IP-based geo restrictions and Sybil filtering via Passport and Score.

The capacity tests for Earndrop are the real tell. The system was stress-tested to handle more than one million simultaneous claim attempts. This is the operational resilience required when a project like Tanssi Network distributes 40.5 million TANSSI tokens pre-TGE. By providing this hardened infrastructure, Galxe shifts the risk and complexity of the TGE away from the protocol team and onto its own dedicated execution layer. This is a powerful value proposition for any protocol approaching launch.

Intelligence vs. Activity: The Starboard Alpha

The strategic shift from a simple task engine to an intelligence platform is embodied by Starboard. This product upgrades Galxe from a transaction coordinator to an analytics provider by combining social and onchain data to identify high-impact contributors. This is the true alpha for protocols spending millions on growth.

Starboard introduces two key metrics: the **Aura Index**, which tracks project-level awareness, and the **Aura Score**, a user-level influence metric. The Score emphasizes engagement from high-signal participants, ensuring that growth spend is not wasted on low-quality activity. For investors, this means that protocols utilizing Galxe can now link their growth budget directly to verifiable, high-quality onchain outcomes, rather than relying on vague Discord metrics.

Consider the 0G example: the campaign drove 2.5 million quest engagements and generated 14.3 million Aura. This is the language of contribution intelligence. By integrating Starboard, Galxe is essentially selling a higher quality of user acquisition, allowing protocols to prioritize the users who will actually drive long-term adoption and network value.

The integration of zkRaffle, a verifiable, tamper-resistant zero-knowledge raffle primitive built with Succinct’s zkVM (SP1), further demonstrates the commitment to verifiable integrity. This is not just about running campaigns; it is about running provably fair, auditable, crosschain reward draws, reducing the trust overhead for participants and projects alike.

The Business Model and The “So What?”

Galxe’s monetization strategy has matured alongside its product stack. The infrastructure is monetized via **Galxe Business+**, a paid SaaS subscription model with tiers (Essentials, Growth, Enterprise). This move from a transaction-based fee structure to a recurring subscription model is crucial. Enterprise tier clients—typically large chains—receive dedicated support, expanded API access, and gas-credit subsidies, locking them into the Galxe ecosystem for their entire protocol lifecycle: from Phase 1 (Awareness, e.g., Arbitrum Odyssey) through Phase 3 (TGE and Long-Term Growth, e.g., Solayer airdrop).

The complex reality is that Galxe has successfully executed its transformation from a frontend utility to a necessary infrastructure layer. The technology stack—Gravity, Earndrop, Starboard—is unified by the identity layer (Passport/Score) and built to handle the highest-risk operational moments (TGEs). This is a strong technical thesis.

However, the future success hinges on three variables. First, can Galxe effectively scale the Galxe Business+ subscription model? Protocols must accept that high-quality growth infrastructure is a recurring, necessary cost. Second, can Starboard deepen its analytics capabilities fast enough to maintain a lead over competing internal data science teams? And finally, the most critical variable: Gravity. While the performance metrics (4,500 TPS, 1.1s blocks) are strong, Gravity must consistently deliver the required real-time performance and resilience through future cycles. If Gravity fails to maintain its status as a hardened, high-throughput execution environment, the entire Earndrop-as-a-Service model collapses. If they succeed, Galxe captures the most valuable part of the protocol lifecycle: the TGE distribution and the subsequent long-term contributor intelligence. This makes the protocol a complex, high-execution-risk bet with massive potential upside.